TRAINING:

CMA students shall have to undergo prescribed mandatory training at Intermediate and Final levels. The Institute is having a robust Training Scheme to groom its students to acquire and apply the knowledge, skills, abilities, and attitudes needed by a particular job and organization and to develop professional expertise.

TRAINING DURING CMA COURSE:

- ‘Skills Training’ and associated assessment tests are mandatory to be eligible to appear in both/remaining group(s) of CMA Intermediate Examinations. However, a student can appear in a single group (either first or second group and not the both/remaining group) of Intermediate Examinations without completing ‘Skills Training’ and associated assessment tests. However, Directorate of Studies recommends that the eligible students should start ‘Skills Training’ activities from the very beginning to their registration in the Intermediate Course. There is no exemption scheme for ‘Skills Training’ and it is mandatory for the students taken registration in the Intermediate Course on or after 11th August 2020.

- Attendance in Skills Training sessions:

- The Directorate of Studies (Training & Placement) recommends regular attendance in the online sessions to grasp over the intricacies of ‘Skills Training’ modules. Attendance of the students in various sessions will be strictly monitored and recorded by DOS.

- A student, enrolling for Final Course under Syllabus 2016 has to complete ‘Industry Oriented Training Programme’ before filling up the Form for Final Examination for both or remaining group(s) of final examination

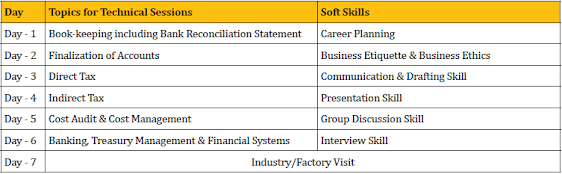

- Training Scheme: This will cover training on compliance requirements and their preparation under various statutes and shall be imparted as under:

PRACTICAL TRAINING:

A Student has to undergo 3 years Practical Training. The Scheme for Practical Training is given in Annexure V. However, a student needs to undergo 15 months Practical Training before appearing in both or remaining group(s) of Final Examination.

12-DAYS PRE-PLACEMENT ORIENTATION TRAINING PROGRAMME FOR FINAL PASSOUT STUDENTS:

Topics covered:

- Resume Writing/ Communication Skills/ Soft Skill Training/ Tips to crack Interview & Group Discussion/ Interview

- Skills/ Professional Email Writing/ PowerPoint Presentation

- Advanced Excel

- ERP

- Basics of Accounting/Corporate Accounting (Practical Aspects)

- Company Law (Special emphasis on Companies Act, 2013)

- Financial Management (Practical Aspects)

- Cost Sheet Preparation [Companies (Cost Records and Audit) Rules, 2014]

- Audits in Corporate World

- Cost Accounting Standards

- Ind AS

- Goods & Services Tax (GST) / Customs Act

- Direct Tax (Practical Aspects)

- Emerging issues: Valuation and Insolvency & Bankruptcy Code

- Securities Market

- International Finance

- Banking, Insurance & Financial Services

- Fees: INR 4,000/- to be paid at the time of registration for this training program.

Source: icmai.in

(The Institute of Cost Accountant of India)

No comments:

Post a Comment